Maintaining portfolio quality Amidst a raging global pandemic

By: | Blog | October 5, 2021 09:00

Performance highlights

CRDB Bank Group emerged stronger in 2020, successfully navigating the challenges presented by the global health crisis. Supported by proactive strategies and strong credit management approaches, the Group achieved significant gains, building on the successes of the preceding year.

During the year, the Group’s Credit portfolio registered a net growth of TZS520 billion year on year from TZS 3,620 billion in December 2019 to TZS 4,140 billion in December 2020. The Bank maintained a relatively stable portfolio mix of corporate and retail loans, translating to a 4:6 (37%:63% in) ratio as of the end of December 2020.

Notably, there was a general improvement in credit portfolio performance in 2020 compared to 2019 as evidenced by a decrease in non-performing loan (NPL) ratio to 4.3% (TZS 177,990 million) in December 2020, compared to 5.52% (TZS199,828 million) recorded in December 2019. The Group achieved this by implementing-active portfolio monitoring strategies through containment of migration, automatic identification of early warning signals and; taking swift corrective actions.

Similarly, there was considerable focus on the strategic growth of portfolio with higher yield but lower credit risk such as consumer loans, activation of a de-risking strategy, timely restructuring of credit facilities to align with the anticipated cashflows and; writing-off accounts in line with central bank guidelines.

Supporting customers during a difficult period

Despite COVID-19 Pandemic, credit portfolio performance was relatively stable throughout the year, albeit with a considerable slowdown in some service sectors, especially hospitality (hotels and restaurants) and tourism. Following the temporary closure of schools, the education sector also experienced disruptions exhibiting a sudden plunge, even as the transport industry suffered a blowback, especially with a sharp decline in exports.

In response to the mitigation guidelines provided by the Bank of Tanzania, the Group took pro-active measures to engage customers in timely and restructured facilities, especially for customers whose repayment abilities had been impaired by the pandemic.

Despite COVID-19 pandemic, credit portfolio performance was relatively stable throughout the year, albeit with a considerable slowdown in some service sectors, especially hospitality (hotels and restaurants), aviation and tourism.

Strengthening credit recoveries

the Group’s efforts to sustain a quality portfolio through recoveries on non-performing facilities continued in earnest as part of the holistic transformation of credit management. During the year, the Group made remarkable recoveries amounting to TZS 12,844 million from written-off accounts, which was an increase of 96% compared to TZS 6,537 million achieved in 2019. The significant growth was attributed to the deployment of effective recovery measures including receivership, own-sale engagements, out-of-court settlements, self-payments and auctions, depending on the nature of the credit facility and expected cash flows of a customer.

Streamlining credit management

The gains made in achieving a quality portfolio did not occur in a vacuum. Throughout the year, the Group focused on sustaining credit reforms, which is key to the sustainability agenda. We made comprehensive improvements to the processes of managing collection from delinquency and Charge-offs portfolio and enhanced the E-collect system for collection and monitoring. The improvements were extended to cover all channels including SimBanking services, CRDB Agents to optimize collections from written-off accounts.

Additionally, we made modified numerous processes in the credit lifecycle, resulting in improved turnaround time in processing credit applications, timely identification

for delinquent accounts and; taken appropriate actions to ensure timely recoveries. Conversely, we improved the Group’s compliance rate of laws and regulations and aligned with best practices of the entire credit lifecycle. This included a review of existing credit processes to establish areas that needed modification and ensure an improved credit portfolio.

To achieve holistic transformation, the Group implemented capacity building initiatives for stakeholders credit lifecycle through conducting training, seminars and facilitating online learning platforms to enrich awareness for healthier credit management. We see this as a sustainable way of building a sustainable and efficient credit ecosystem.

Looking ahead

the Group continues to monitor closely credit facilities of accounts whose cashflows have been impacted directly or indirectly by COVID-19 Pandemic. The exercise will also consider amending current cashflow projections by extended moratorium period of either principal only or principal and interest after throughout review of their cash flows.

Likewise, we will press on with strategic lending for sectors impacted by the COVID-19 pandemic, as part of our strategy to support the country’s economic recovery efforts. Strategically, we will accelerate the automation of credit management processes such as credit appraisal for SME and MSE to lessen the turnaround time and aggressively grow the retail portfolio in 2021.

What's new?

BLOG

Wateja wapongeza Mageuzi ya Mfumo Benki ya CRDB ikisherehekea Wiki ya Huduma kwa Wateja

...

Read More

BLOG

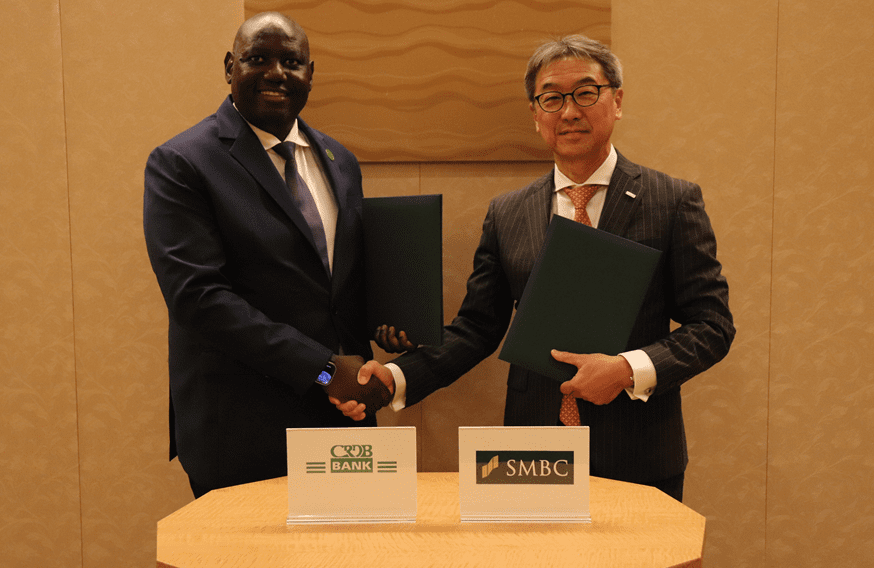

CRDB Bank Formalizes Strategic Partnership with Japan's Sumitomo Mitsui Banking Corporation

Yokohama, Japan – August 21, 2025 – We at CRDB Bank PLC are excited to announce a historic milestone...

Read More