Pata Mkopo. Pata Lipa Hapa

Fungua Akaunti ya Hodari kukuza biashara. Pokea malipo na pata mkopo wa biashara.

NAVIGATE TO

Quick Links

FROM CRDB

Mwanahisa

EVENTS

Sun

10

May 2026

Samia Bond has a 5-year tenure, carries a 12% coupon paid quarterly, with interest commencement date of 10th February 2025 and matures on 10th February 2030.

Thu

23

Apr 2026

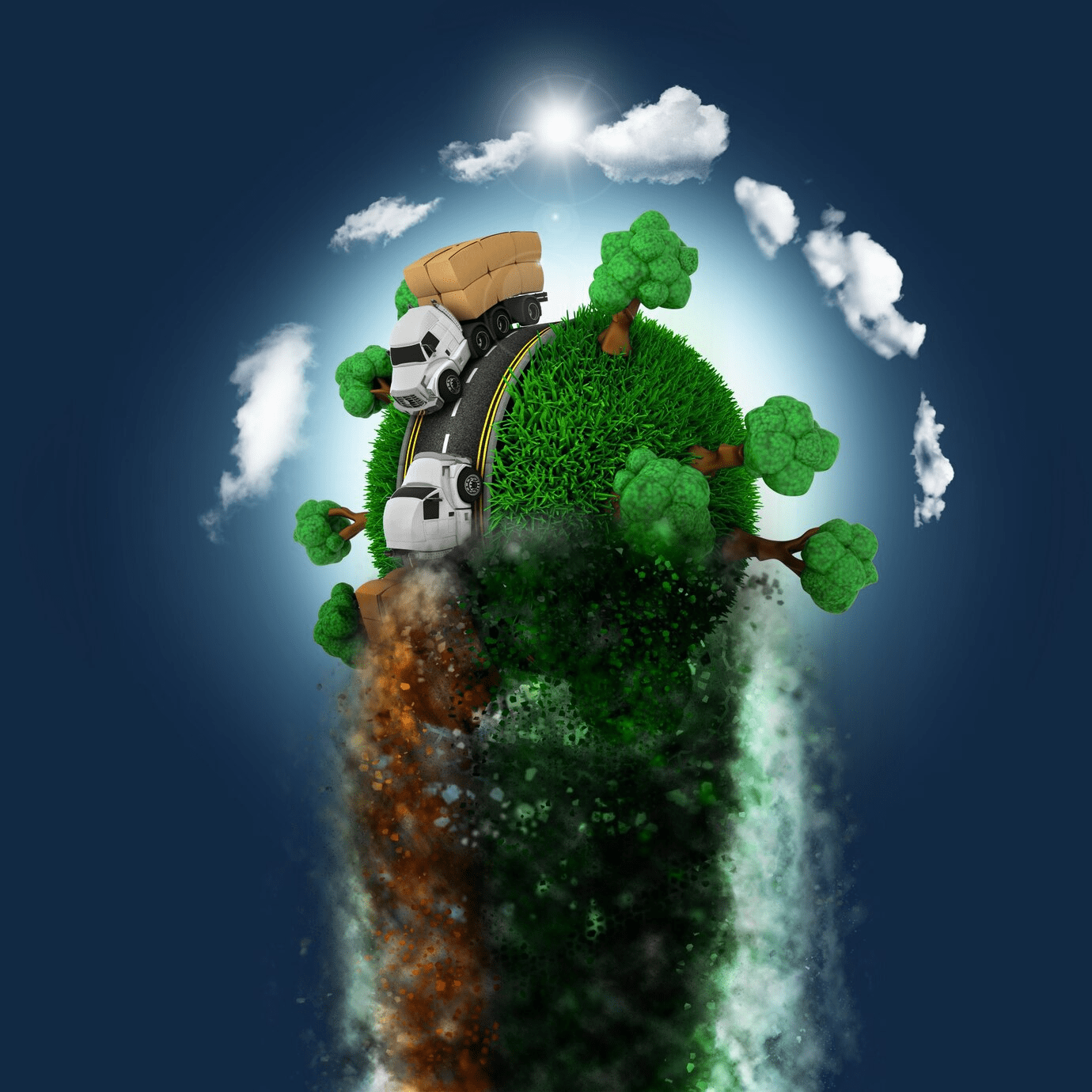

Green Bond has a 5-year tenure, carries a 12.5% coupon paid biannually, with interest commencement date of 23rd April 2024 and matures on 23rd October 2028.

Wed

08

Apr 2026

Al-Barakah Sukuk has a 5-year tenure, carries a 12% profit paid quarterly, with profit payment commencement date of 8th October 2025 and matures on 8th October 2030.

CRDB BANK IN NEWS,CUSTOMER STORIES,GROWING BUSINESS

CRDB Bank launches “Benki Kimpango Wako”, pledging enhanced services for customers and stakeholders in 2026

Read MoreCRDB BANK IN NEWS

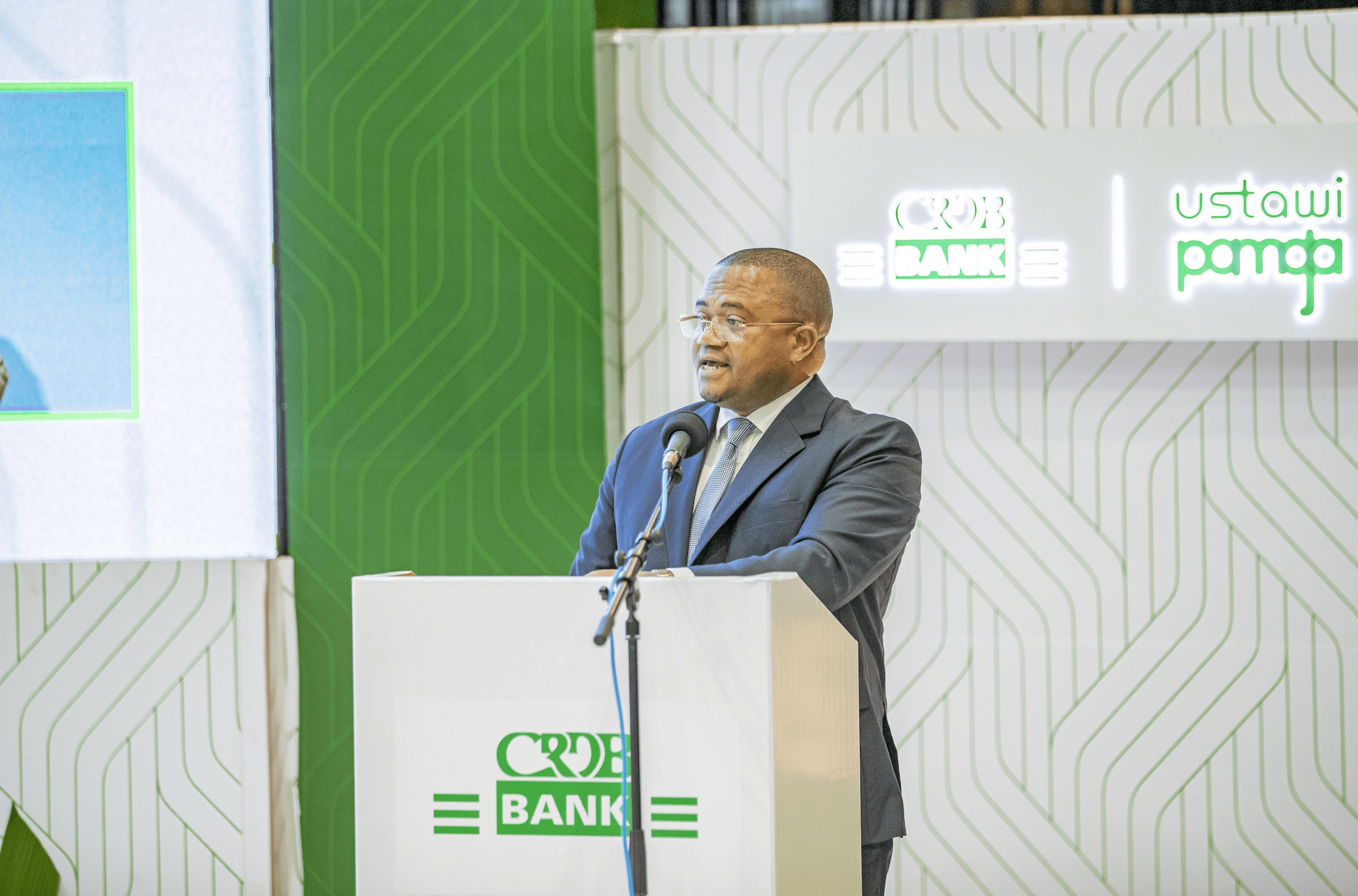

Why CRDB Bank shareholders must wear broad smiles again

Shareholders of the CRDB Bank Plc must be wearing broad smiles as the lender’s equity price has risen by 38.4 percent during the past five months, propelled primarily by investors’ hope for lucrative returns as profitability improves further. The lender’s share price closed at Sh270 each last week, up from Sh195 in December 2020.

CRDB BANK IN NEWS,GROWING BUSINESS,BEYOND BANKING

CRDB Al Barakah Sukuk raises a historic TZS 125.4 billion and USD 32.3 million

Read MoreShareholders may contact us via the following address:

Company Secretary CRDB Bank Plc

Office Accommodation Scheme- Azikiwe Street, 4th Floor

S. L. P. 268 Dar-es-Salaam

Phone: 022 - 2114237, 255 753 260 176 - Fax no. 022 - 2131005

Email: [email protected], [email protected] or [email protected]

The procedures for tracking dividends are as follows;

- The shareholder will write a letter to the secretary demanding unpaid dividends.

- He will deliver the letter to any CRDB bank branch near him

- He / she will fill in a shareholder record form which will attach a copy of the stock certificate and his / her National Identity / voting / passport / driver's license and leave it at the branch and send it to the Secretary.

If a shareholder loses his or her share certificate, he or she is advised to report it to the police so that they can obtain a police report for the loss of a share certificate (Police report) and submit to the nearest CRDB bank branch to complete and submit the following documents:

- Application letter

- Fill in the CDS Amendment form (CDS Amendment form).

- Fill in the Replacement form.

- Police Loss Report Loss Report

- Copy of Applicant ID.

- Bank receipt of payment TZS 2,000 / = (on Account no. 0150305954000) if it is the cost of creating a new certificate with the Dar es Salaam Stock Exchange.

After the death of the shareholder, the family is required to sit in a session and appoint an executor who must be certified by the court, the executor must follow the order of the deceased's estate in court in accordance with the law. After all the formalities have been completed, the executor of the estate should send the following documents to any branch of the CRDB bank nearest to him or to the Secretary of the Bank:

- Application letter

- Letter of appointment for appointment of Administrator of Inheritance (FORM No. IV)

- Fill in the CDS Amendment form (CDS Amendment form).

- Copy of Certificate of Death of the deceased

- Summary of Brotherhood Session (Minutes)

- Copy of Administrator / Successor Identity ID

- Bank Receipt of Payment TZS 2,000 / = (Account no. 0150305954000) if it is the cost of creating a new certificate with the Dar es Salaam Stock Exchange.

- Copy of birth certificate of executor / National Identity Card

- Copy of marriage certificate of marriage executor

- Original CDS Receipt

If the executor of the estate does not have a share certificate, he or she will have to fill in a DSE Replacement form and get a Police notification of the loss of a share receipt.

Another option is through one of the Dar es Salaam Stock Exchange (Licensed Dealing Members of DSE) agents.

The shareholder may change its share information by doing the following:

- Application letter

- Original CDS Receipt or Copy of Shared Certificate

- Bank Receipt of payment of TZS 2,000 / = (on Account no. 0150305954000)

- CDS Amendment form

- Copy of National Identity Card / Vote / Passport

Can a shareholder use a CRDB Bank share certificate as collateral to apply for a loan from CRDB Bank? Can shareholders borrow through their shares?

The law does not allow a Shareholder to borrow on the securities of his Shares in the same bank/company in which he owns the shares, to do so is tantamount to borrowing oneself thus reducing capital. However, Shareholders may apply for and obtain loans from the Bank through other standard procedures such as other clients. They can also borrow through other banks using their CRDB bank shares as collateral for a loan.

There are two ways a shareholder can use it. The first step is to go directly to the stock market brokers who will give you advice on selling or buying stocks and make arrangements to buy or sell stocks.

The second option is through CRDB Bank as the Dar es Salaam Stock Exchange Auction Agency (Solomon Stockbrokers) through all CRDB branches.

CRDB Bank as an agent of Solomon Stockbrokers is involved in the whole process of selling and buying shares, taking into account all the criteria set by the Dar es Salaam Stock Exchange and the Stock and Capital Authority.

In fulfilling the agency's role the Bank expects the investor to make the right decisions, and in-depth scrutiny, including obtaining professional advice before investing in stocks.

Stock Exchange

However, CRDB Bank offers the opportunity to contact consultants if you need to make contact with them. All CRDB Bank branches offer a sale/purchase of shares.

These steps will be followed by the investor when applying for a share sale:

- He or she will be provided with information on stock prices, shares sold, shares purchased, and the number of shares sold;

- He or she will fill in special forms for the sale of shares and that of important information about the investor;

- He will be required to leave the DSE Depository receipt;

- The officer in charge will inspect the forms carefully before processing them;

- It is best to leave simple communications, including cell phone numbers, for quick reference information.

The bank as an agent should determine the legitimacy of share ownership, the investor will also be required to provide other visas such as a passport, work ID issued by a known employer, and a voter ID.

Investors will be given direct contact with the auctioneer, namely SOLOMON Stockbrokers so that they can closely monitor the progress of their share application, and possibly change pre-orders where necessary. This will help the investor to make quick decisions based on market speed when he sees changes in the stock market.

Stock Purchase

These steps will be followed by the investor when applying for a stock purchase:

- He or she will be provided with information on stock prices, shares sold, shares purchased, and the number of shares sold.

- He or she will be required to complete a stock transaction form and that of important information pertaining to the investor;

- He will deposit the money (Deposit) in a special auctioneer account available at CRDB bank.

- He will be given a receipt for payment as proof of payment, which he will be required to show at the branch upon receipt of the DSE Depository Receipt.

- Payment should be made in cash, check or transfer if the paying account is in any branch of CRDB Bank.

- Payment by check should not exceed 10 million shillings as required by Central Bank procedures, otherwise, the payment should be made through TISS (Tanzania Interbank transfers)

Normally when a company announces a dividend date (usually taking more than 14 days or more) the shares will be sold on dividends as well as dividends declared in it (Cum dividend). Thus any Shareholder who sells its shares during this period will lose its dividend entitlement and thus even receive dividends, and the Shareholder who buys Shares in this period will be eligible to receive dividends so he will receive the dividend.

If the Shareholder buys shares after the date on which the Company has closed the dividend period, the shareholder shall purchase the shares without a dividend for the duration of the period until the Company re-announces the dividend date or for another year, for companies that pay dividends immediately. per annum. Similarly, the Shareholder who sells his shares during this period will still be entitled to receive his dividend, in addition to having sold his shares.

So these periods are very important to consider, to avoid the risk of selling shares while relying on dividends, while the period you are selling is the period in which the buyer is the dividend will go to him, and if you sell this period it is best to seek professional advice. the cum dividend period should be relatively high depending on the dividend to be given. So even if you sell this period you will consider the price that will cover the release of the specified dividends.

Support

Still Got Questions?

Get in Touch, We're Here to Listen and Support